Retroactive Tax Credits 2024 Form To Print – The credit can be claimed on the federal tax return (Form 1040 or 1040-SR) and must be filed by April 15, 2024 at the latest, or by October 2024 with a tax extension. A claimant must also fill out . To claim the credit, EV drivers must file Form 8911 your taxes in 2024 if you purchased, installed and began using an EV charger at your residence during the most recent tax year. .

Retroactive Tax Credits 2024 Form To Print

Source : twitter.com

ICYMI | Current Developments in California, Florida, Indiana, and

Source : www.cpajournal.com

Devin Neitzel, CPA Tax Associate Eide Bailly LLP | LinkedIn

Source : www.linkedin.com

EV Tax Credit: How It Works and Which Vehicles Qualify WSJ

Source : www.wsj.com

Did you know 36 states have enacted PTE tax laws to enable owners

Source : www.tafttaxinsights.com

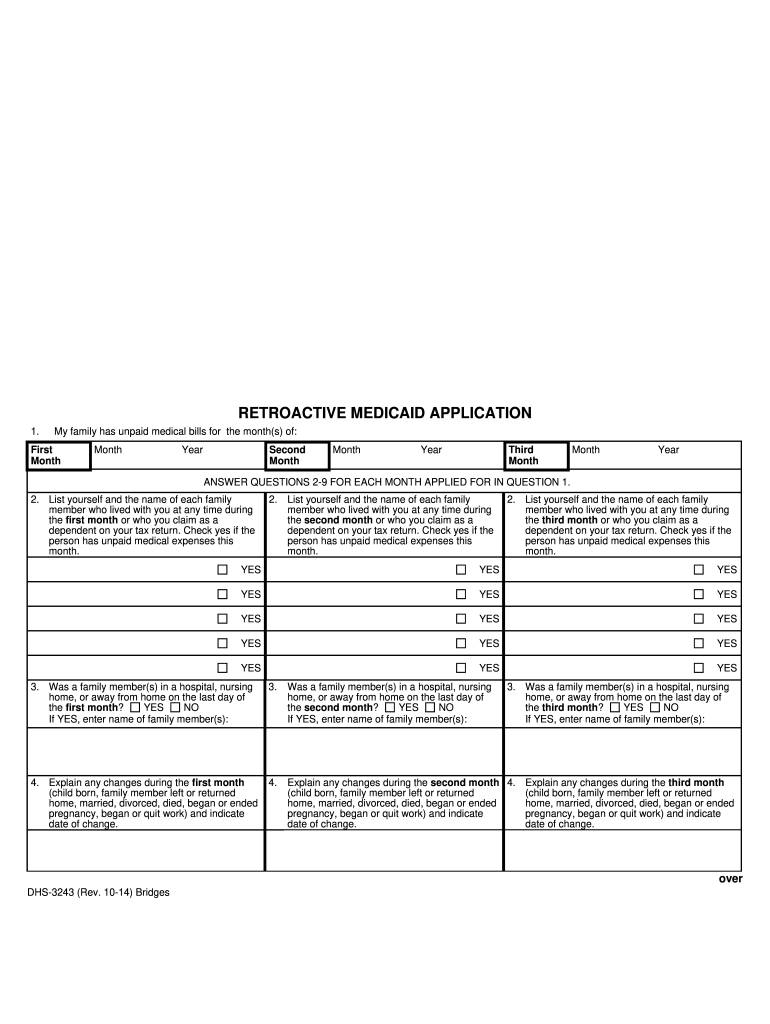

2014 2024 Form MI DHS 3243 Fill Online, Printable, Fillable, Blank

Source : www.pdffiller.com

Who gets a break? Clashing ideas on tax relief are teed up for the

Source : apnews.com

Employee Retention Tax Credit FAQ [Updated For 2023]

Source : snacknation.com

Who gets a break? Clashing ideas on tax relief are teed up for the

Source : apnews.com

New Electric Vehicle and Home Energy Tax Incentives WSJ

Source : www.wsj.com

Retroactive Tax Credits 2024 Form To Print Joe Kristan on X: “Iowa extends PTET deadline for 2022 retroactive : The Inflation Reduction Act offers a tax credit worth up to $7,500 to those who buy new electric vehicles. It also offers a $4,000 credit for used EVs. New rules for 2024 will allow buyers to get . A $7,500 tax credit for electric vehicles will see substantial changes in 2024. It will be easier to It’s generally Line 11 on your 1040 form, but if you have foreign income or income from .