Eligibility Criteria For Child Tax Credit 2024 Program – The utmost refundable portion of the CTC is projected to increase from the current $1,600 per child to $1,800 in 2023, $1,900 in 2024, and $2,000 in 2025, according to the framework. . Child Tax Credit 2024 Requirements: In 2024, if there are any modifications to the Child Tax Credit eligibility criteria, which could affect as many as 48 million applying American adults who require .

Eligibility Criteria For Child Tax Credit 2024 Program

Source : www.investopedia.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : kvguruji.com

IRS Issues Table for Calculating Premium Tax Credit for 2024 CPA

Source : www.cpapracticeadvisor.com

Child Tax Credit 2024 Requirements: Are there new requirements to

Source : www.marca.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

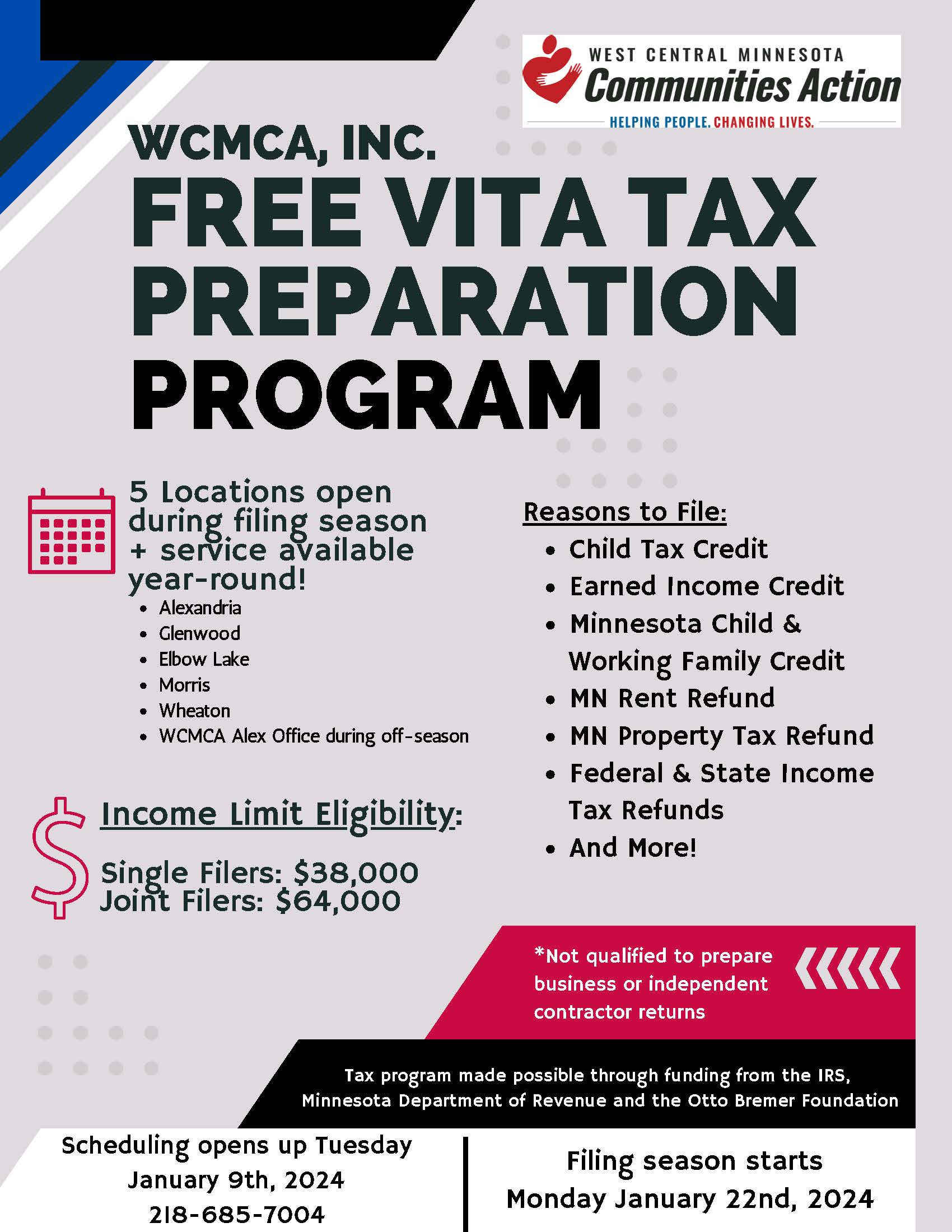

Free Tax Preparation West Central Minnesota Communities Action, Inc.

Source : wcmca.org

Child Tax Credit 2024: How Much You Could Get and Who’s Eligible

Source : www.cnet.com

Child Tax Credit 2024 Income Limits: What is the income limits for

Source : www.marca.com

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

Eligibility Criteria For Child Tax Credit 2024 Program Child Tax Credit Definition: How It Works and How to Claim It: To be eligible for the child tax credit, you must be a parent or guardian filing taxes in 2024. The child or dependent must have a Social Security number valid for employment in the U.S. and be under . The 2024 tax season is starting soon, and you may be looking for all the tax credits you’re eligible for. If you have kids, you probably already know whether you’re eligible for the federal child tax .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)